WHEAT

The grain market was quiet on Friday, with the US market slowing down for the Presidents Day Holiday weekend.

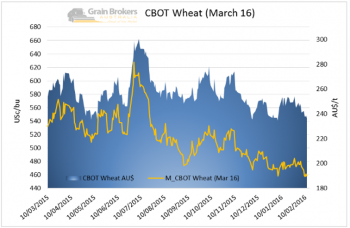

CBOT March 16 futures finished the week lower at 457.2US¢/bu down 15.4 US¢/bu for the week.

This week saw the release of a very bearish USDA report on Tuesday evening our time. The USDA added 6.8 million tonnes to global wheat ending stocks to a record 238.9 million tonnes. The increase in stocks mainly came from reduced demand from India and China. Wheat usage in China is estimated to be 4.7 million tonnes lower than January’s report as the governments internal economic food policies favour other grains. Global production was revised higher in Argentina (+0.5 million tonnes) and Ukraine (+0.3 million tonnes). Australian wheat remained unchanged in the report at 26 million tonnes – way too high!

Egypt tendered for wheat on Monday and received no offers to do uncertainty about quality restrictions. Egypt in an attempt to clear that up Egypt’s Supply Ministry and GASC have both confirmed that they will accept shipments with up to 0.05% of ergot, and reissued a tender and purchased one cargo of Romanian wheat at US$190.88/t (Cost and freight). It is reported that Bunge has launched legal proceedings to challenge the decision made by Egypt to reject the French Cargo.

India is predicted to harvest its smallest wheat crop in six years after two successive years of below-average monsoon rainfall. The Indian government estimate that Indian wheat production is at 93.8Mt. This figure is down from 95.9Mt last season (USDA) and below government targets of 94.8Mt. This potentially opens the door for wheat imports from Australia.

Attaché estimate, Canadian wheat plantings will fall to a 5 year low of 9.26 million hectares in 2016. This estimate is below the initial estimate from the International Grains Council which sits at 9.5 million hectares.

Russian Ukraine wheat crop at risk. Recent mild temperatures and rainfall has reduced snow cover across central and southern Russia and eastern Ukraine. With some regions of Ukraine are seeing problems of freezing with almost a third of the crops at risk. A close eye will be kept on what the weather does now as we enter that final period of winter as there are a couple of scenarios that could play out and result in elevated levels of winter kill this year.

To read the full report click the below link

Weekly Report 16_02_12