BEANS/CANOLA

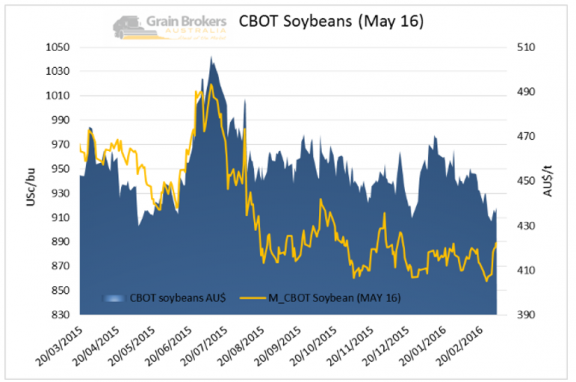

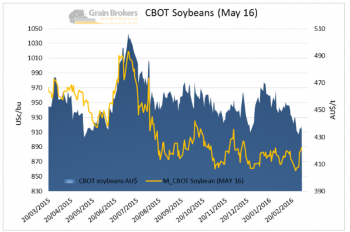

Chicago May-16 soybean rallied and settled at 889.2 US¢/bu on Friday, the sharp rise owing to strong soybean oil exports.

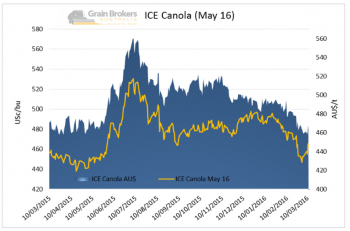

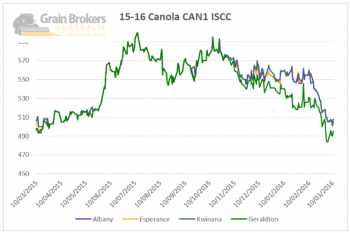

Canola followed soybean over the week with ICE Canola March 16 finishing at CA$465.3 up CA$13/t for the week.

Last week’s WASDE report saw US ending stocks at 12.5 million mt a 272,000t increase, on account of lower domestic demand. However on a global scale ending stocks were reduced to 79 million mt (still a record.)

The strength of the Brazilian real, as well as strong demand for US soybeans helped to support US soybean prices last week. On Friday, the Brazilian real rose to an over six month high against the dollar, reducing the relative competitiveness of Brazilian exports. A planned trucking strike in Brazil failed to materialize into anything meaningful. There were no reports of any disruptions. Another supporting factor has been delays faced by soybean shipments in Brazil, with ship line-ups of up to 57 days reported at southern Ports.

With Brazilian harvest now at 41% complete the Brazilian government crop supply agency Conab lifted its forecast for soybean production last week to a record 101.2Mt. The latest forecast is 250Kt higher than January’s forecast, on account of gains in area planted and yields.

To read the full report please click the below link.

Weekly Report 16_03_12