WHEAT

Grain markets ended the month of January making up some of the losses they started the year off with. Wheat managed to finish up almost 2% up from where it started the year.

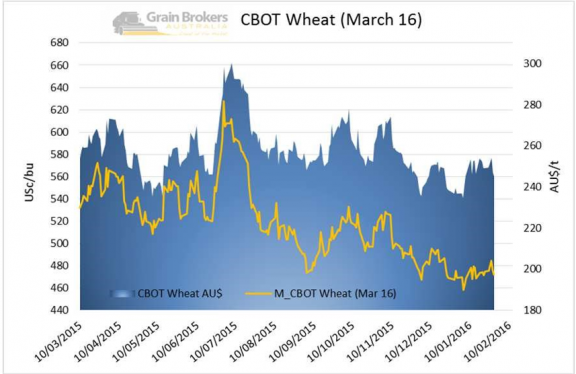

CBOT March 16 futures finished the week slightly lower at 472.2Usc/bu down 2.8 USc/bu for the week.

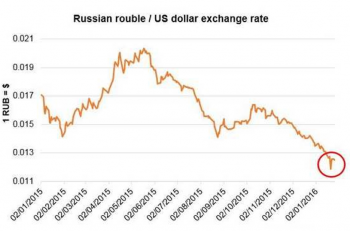

In Russia the Ruble has fallen to an historical lows – US$1=84.24 RUB. A fall in the Ruble has caused the local Russian grain price to rise, placing pressure on the pig and poultry margins. As a result changes to the export system are being considered to support domestic end users, a decision will be made on 3rd February.

Speculation of potential changes to Russian grain export policies supported wheat futures early in the week, with wheat futures closing up 9.2USc/bu on Tuesday.

Over the weekend, there was confirmation that Egypt had rejected 63Kt of French wheat due to the presence of ergot. The Egyptian agriculture minister has specified a zero tolerance on ergot. Despite a 0.05% allowance in international standards.

Worries over the size of Indian 2016/17 wheat crop has prompted flour millers to call for the 25% duty on wheat imports to be removed from April. Wheat plantings were down 7% year-on-year at the end of December due to a lack of rainfall and the unfavourable conditions have persisted into January. This is the second year of challenging conditions, and could lead to increased import requirements.

In the short term the outlook is downward, with the market holding out for news of the Northern Hemisphere crops coming out of dormancy, however there will be no clarity until mid-March.

To read the full report click the link below.