WHEAT

Wheat CBOT Dec 15 futures made positive gains for the week, and finished at

515USc/bu. up 24.4USc/bu week on week.

US wheat prices traded higher this week as better than expected export sales came amid forecasts for more rain in the winter wheat areas, and as fund participants sparked a round of buying.

The USDA has lowered Australia wheat crop estimate to 24 million tons

We continue to monitor the northern hemisphere crop progress, as the market is very sensitive to any developing production concerns.

The US winter wheat is currently at 83% planted up 7% from last week. The first condition rating was also released, the good/excellent score was 47%. This is the lowest rating in 3 years and well below analysts’ expectation for 55%.

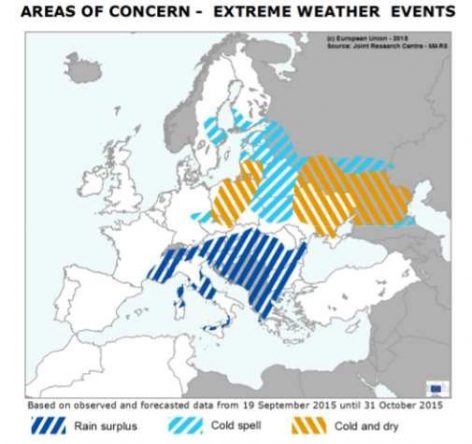

The extreme weather map shows that large areas of Italy and eastern Europe experienced abundant rains. In Eastern Europe, the excessive rainfall hampered the sowing of winter crops.

In Poland, dry conditions have persisted since summer. The winter crops sown in September therefore germinated under unfavourable conditions which further worsened due to the low temperatures that occurred in October. Similar problems occurred in the Baltic countries, especially Lithuania. In Ukraine and Russia. Reports out of the Black Sea are suggesting 50% of the winter wheat is rated in poor condition. This story is unlikely to play out until the northern hemisphere spring.

The Russian wheat plantings pace is at the 5yr average, however in Ukraine continues to lag and is about 12 to 17 days behind where it should be and is at 82% complete.

Local pricing has followed the offshore market higher this week making gains of $ 6-9 across all zones. However the full extent of the gain has not been passed along, as basis continue to slide.

To read the full report follow the below link.

Weekly Report 15_10_30